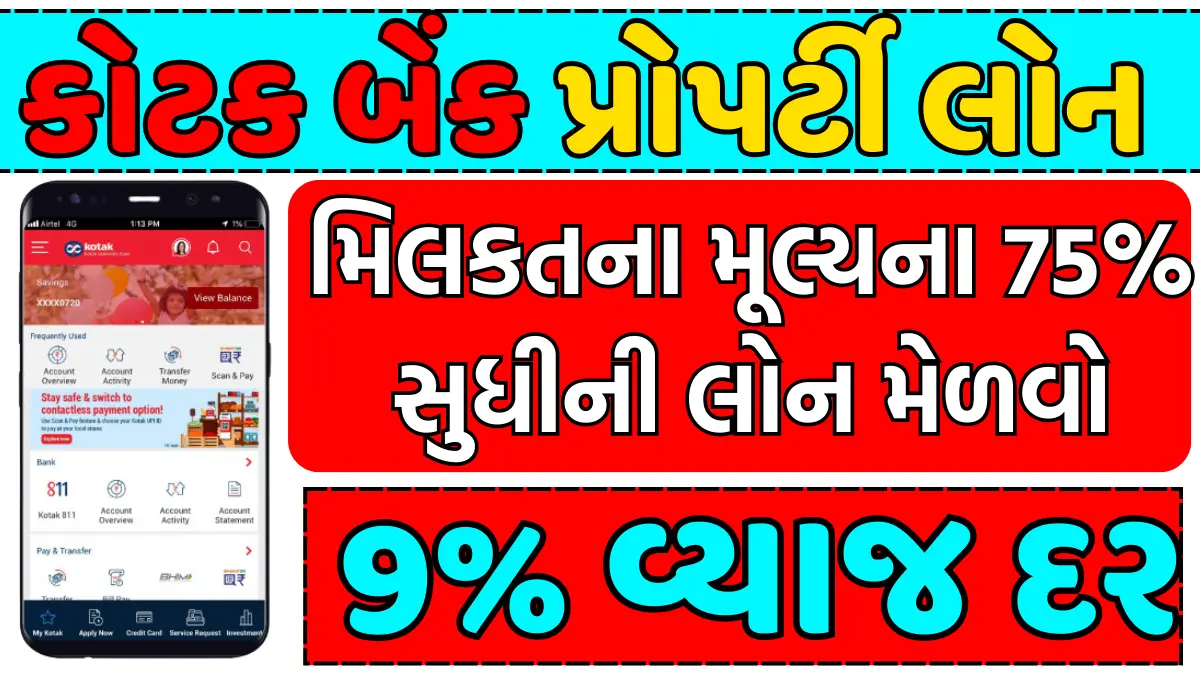

If you own a property and need funds for financial needs, you can avail Loan Against Property (LAP) from Kotak Bank. LAP is a secured loan in which your property acts as collateral for the repayment of the loan.

How to get loan against property from Kotak Bank?

Kotak Bank also provides loan facility to its customers against their property. It doesn’t matter whether the customer has an account with Yes Bank or not, but if you take a loan from this bank, your CIBIL should be good and you should have a valid property against which you can take the loan.

Eligibility :

- Property: You should have owned property in India which can be used as collateral for LAP.

- CIBIL Score: You should have a good CIBIL score of 700 or above.

- Income: You should have a steady source of income that shows your ability to pay the EMIs.

- Other Documents: You will need to submit documents like PAN card, Aadhaar card, identity proof, address proof and property documents.

Loan Amount:

The amount of LAP you can get depends on the value of your property, your income and CIBIL score. The maximum loan-to-value (LTV) ratio is 75%, which means you can get a loan of up to 75% of the value of your property.

Interest Rate:

The interest rate on LAP depends on your CIBIL score, loan amount and repayment term. Interest rates usually start at 9%.

Application Process:

- Visit Kotak Bank Branch: You need to visit the nearest Kotak Bank branch and apply for LAP.

- Fill the application form: You have to fill the LAP application form and attach it with required documents.

- Appraisal by Bank: The bank will appraise your property and review your application.

- Loan Approval: If your application is approved, you will get the loan amount in your bank account.

Advantages of LAP:

Low Interest Rate: Since LAP is a secured loan, it is available at a lower interest rate than other types of loans.

High loan-to-value ratio: You can borrow up to 75% of the value of your property